How are engineering leaders approaching 2026 AI tooling budgets?

2026 brings bigger AI budgets, higher adoption, more tools, and more pressure to measure ROI.

Welcome to the latest issue of Engineering Enablement, a weekly newsletter sharing research and perspectives on developer productivity.

🗓 On November 20th, Abi and I are hosting a live discussion on running data-driven evaluations of AI engineering tools. Register to join here.

As engineering leaders are busy putting together their 2026 budgets, questions about AI spending and AI tool ROI have been common conversation topics. Earlier this month, DX surveyed 50 engineering budget holders to gauge their approaches to AI spending in 2026. Most of these leaders were actively drafting or had just recently finalised their budgets, and here is what we found.

AI budgets are growing in 2026

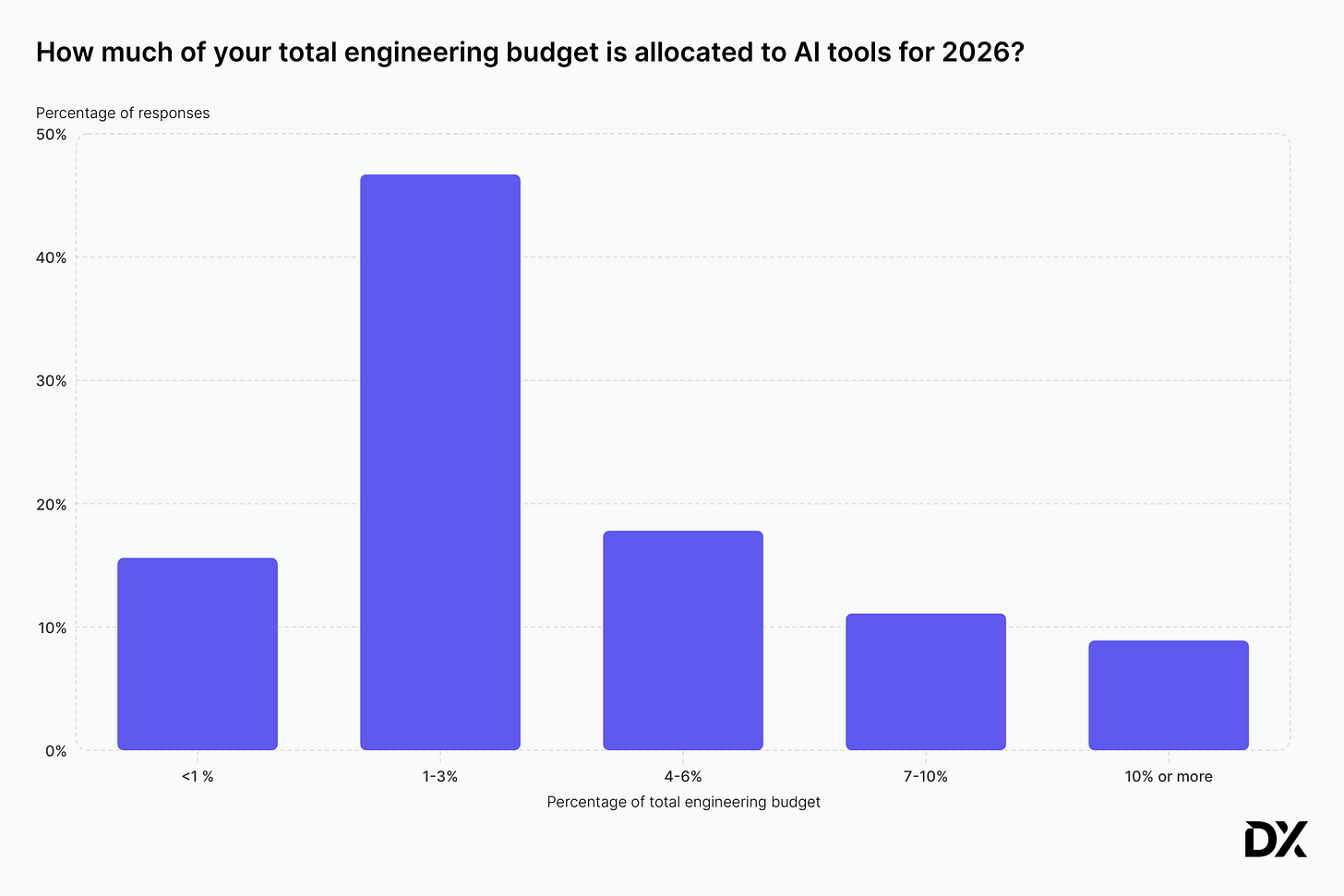

Nearly half of leaders reported that they’ve set aside between 1-3% of their total engineering budgets for AI tools.

In terms of what this means with respect to actual cost per engineer, we can look at another recent poll of 275 engineering leaders. When asked about their 2025 spending, 38.4% of leaders shared they are currently spending between $101-500 per developer per year on AI developer tools. 10.5% came in at $501-$1000 per developer/year, with another 10.5% sharing that they were already spending over $1000 per developer/year on AI tools.

For 2026, budgets are going up to reflect higher usage, but also the larger number of tools on the market. $1000 developer/year emerged as a target for many companies, but my personal prediction is that this number will be higher by the second half of 2026 to accommodate both increased adoption and a wider variety of AI tooling use cases.

Companies that want to make AI tools available for every developer should expect to spend anywhere from $500/dev/year on the low end to easily $3000+/dev/year on the higher end, especially if developers get access to multiple tools covering multiple use cases.

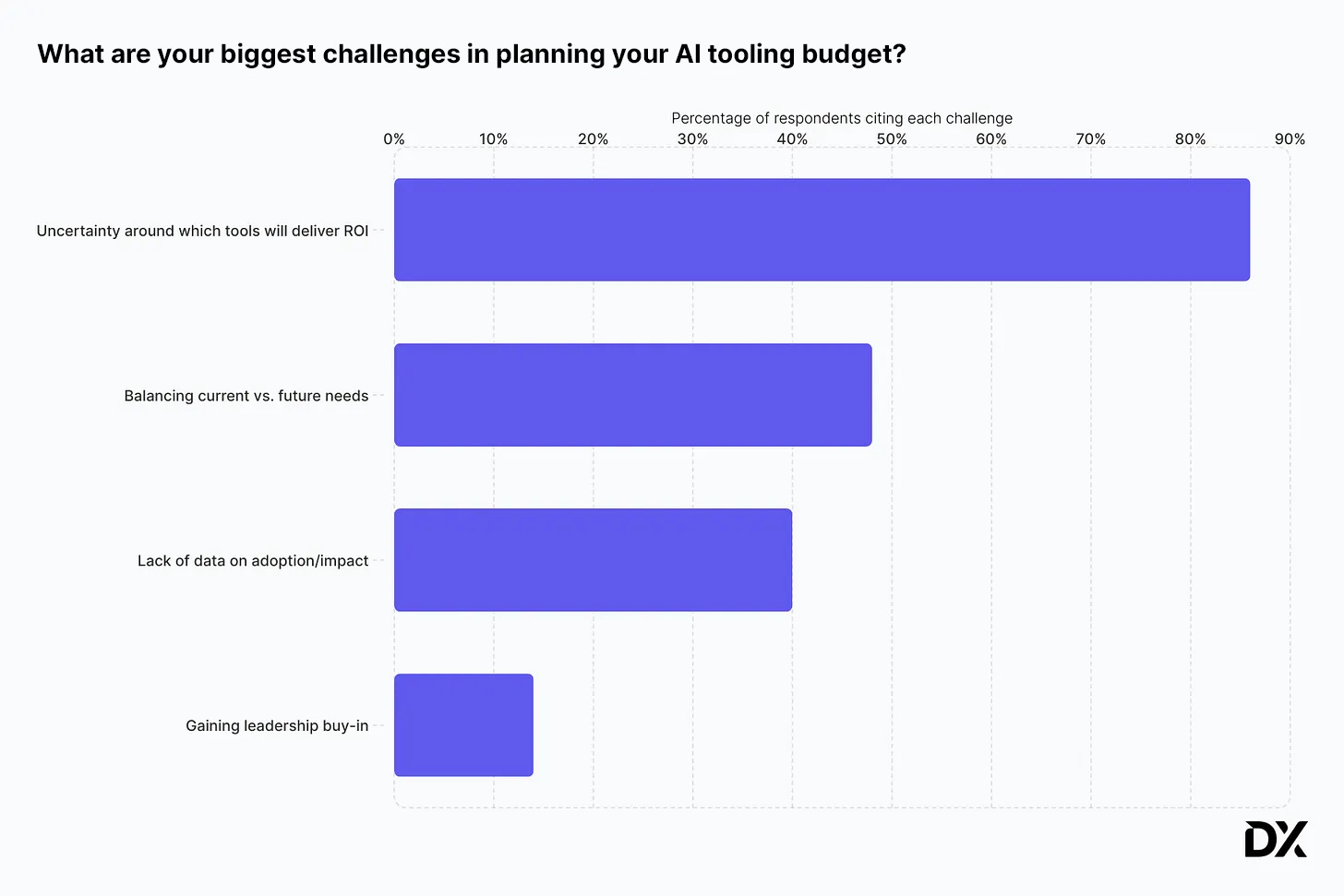

Measuring impact is essential for budgeting decisions and reporting on ROI

With even more money going out the door for AI tools in 2026, leaders are feeling pressure to demonstrate how these investments are bringing results back to businesses. When asked about their biggest challenges in planning AI budgets, 86% of leaders shared that they feel uncertain about which tools are providing the most benefit. 40% reported that they didn’t have enough data on adoption and impact to put together a story around ROI.

Last month, I shared a report on how 18 companies measure AI impact, along with guidance on measuring the impact of AI tools in your own organisation. This mix of real-world metrics and guidance from our experience working with 400+ companies is meant to help exactly those leaders who feel stuck in a measurement gap. Big budgets mean a lot of pressure to demonstrate results, so make sure you are thinking about measurement early – and earmarking resources for measurement as well – in order to validate your strategy and get insight into how AI is really changing the way your organisation builds software.

Multi-vendor approaches are the norm

In most other circumstances, companies avoid paying for multiple tools in the same category, but the rapid innovation currently happening in AI tooling has made this category an exception. This is one reason why AI costs will continue to rise in 2026. Almost all companies I speak with take a multi-vendor approach to AI tooling for engineers, for a few reasons.

Locking into one vendor may mean missing out on the newest capabilities. Many companies are interested in having AI tools available that cover chat interaction, IDE autocomplete, agentic IDEs, and/or background agents. Tools are leapfrogging each other when it comes to capability offerings, but no tool has pulled ahead as a one-stop vendor for all of these interaction patterns.

There are also some wide gaps in performance when it comes to use cases; for example, some tools are better at mobile development use cases, and other tools are great for legacy migrations. Staying flexible with multiple tools helps mitigate lock-in risk and ensures flexibility to use tools that address specific business needs.

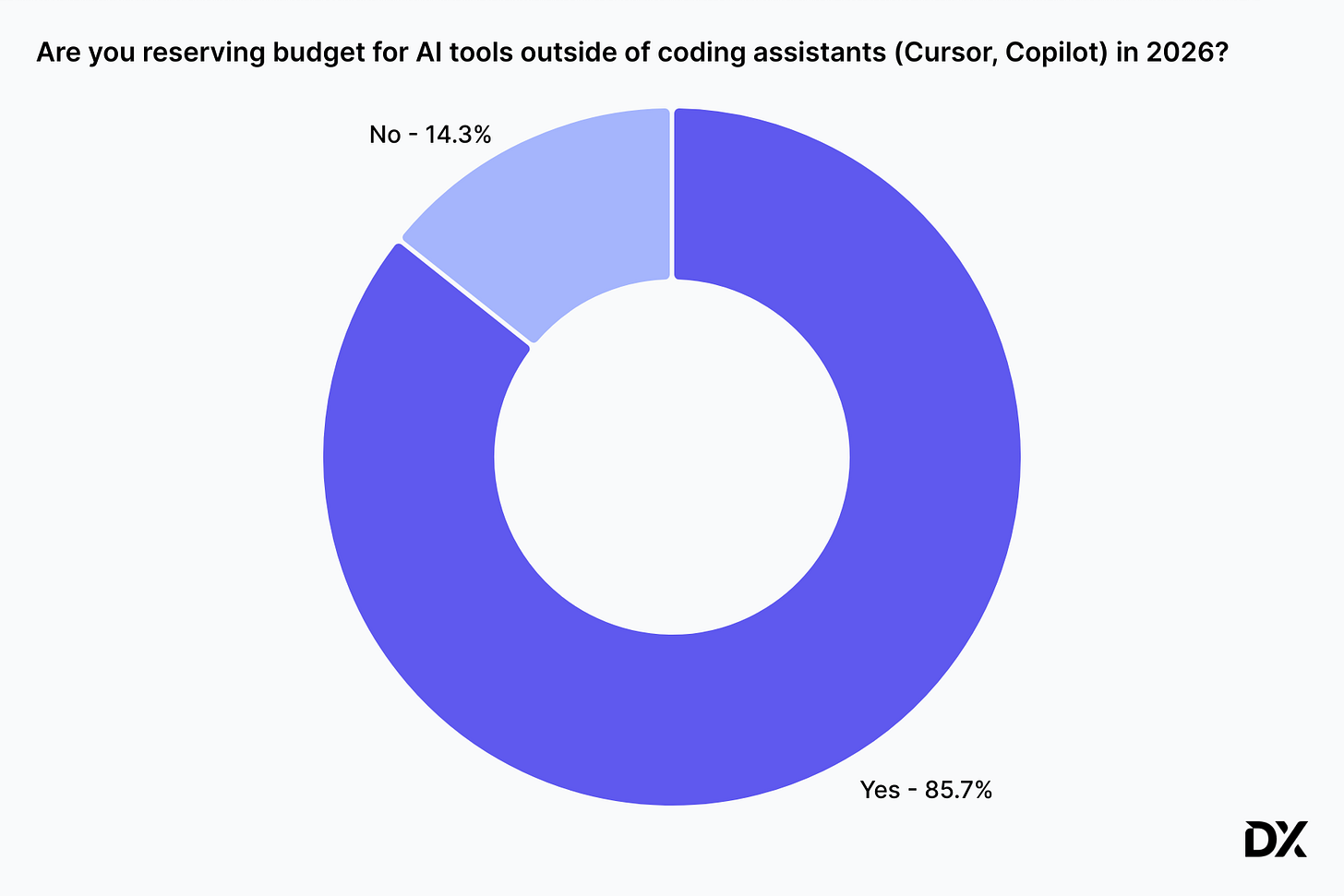

Think beyond code assistants, and save about 15% budget for them too

2026 will also see a lot of expansion in the AI tool ecosystem beyond AI coding assistants like Copilot, Cursor, and Claude. 85.7% of leaders surveyed shared that they are reserving some cash in their 2026 budget for AI tools that are not directly related to code authoring. These might be tools around code review, debugging, and security tools, but also AI tools on the project planning side, and tools for documentation.

We’re generally seeing leaders earmark 15-20% of their AI tooling budget for additional use cases beyond code authoring. Some companies are also adding in around 10% for challengers in the AI code authoring category.

Concretely, for a company budgeting $1000 per developer per year, this would mean allocating $750 to code authoring tooling, and using the remaining budget for experimentation or commitments to other AI tools.

Over half of leaders are thinking about controlling the cost of their AI spend

As more companies mature in their adoption of AI tools, we notice a heavier emphasis on the financial aspects of the AI tooling story: a better understanding of ROI, and better control over license and usage costs. AI vendors are catching up here with capabilities in their product offerings and admin control planes. Most tools already have telemetry which can report token spend and overall cost. Some tools, like Claude Code, have more mature cost monitoring capabilities that you can use to be alerted to cost spikes or other usage anomalies.

Many engineering leaders I speak with are looking for a way to limit spending based on team identity or even attributes like job title (for example, giving staff engineers a bigger bucket of token money than junior engineers). Most usage-based enterprise plans don’t yet have that level of granularity when it comes to cost control, but a few vendors I spoke with said it’s already something they’re considering.

The cost control topic brings us back to ROI, which brings us back to measurement. It’s very difficult to know where to limit cost and where to invest further if you don’t have measurements in place to understand the impact AI is having on your organisation. With DX’s AI Impact reporting, you can break down usage patterns by attributes like team identity, seniority, or primary language, to give you a more complete picture of what groups are seeing the highest returns from AI.

In short: key considerations for 2026 AI budgeting

Expect cost increases in 2026 as both raw cost and overall adoption increase.

Factor in a % of the budget for tools that challenge incumbents and expand capabilities across the SDLC. Many companies are setting aside 20-25% for new tools and experimentation.

Multi-vendor approaches are the norm. DX recommends this approach to stay flexible and take advantage of modern tooling, but costs can add up quickly.

Data-driven pilots and continuous measurement are critical to understanding ROI. The pressure is on to show the ROI of tools as they get more expensive, and measurement is essential. For guidance, check out the AI Measurement Framework and save your spot in our upcoming webinar on data-driven AI tool evaluations.

Who’s hiring right now

This week’s featured DevProd job openings. See more open roles here.

Intercom is hiring a Senior Forward Deployed Engineer | Dublin, London, San Francisco

Multiverse is hiring multiple roles (London, hybrid):

Product Director - Platform

Senior Software Engineer - Developer Experience

Whatnot is hiring a Software Engineer - Platform | San Francisco, Los Angeles, Seattle, NYC

Deliveroo: Staff Platform Product Manager | London

GEICO: Senior Product Manager - Reliability | Palo Alto, CA; Washington, DC

That’s it for this week. Thanks for reading.